How Do I Register Credit Card Payments In The Qb Register

- Manual entry of credit card charges gives you the most current and authentic data. This method eliminates the lag between the time of the transaction and its posting to your statement.

- Manual entry is especially important if you use accrual accounting.

- Entering credit carte du jour transactions to QuickBooks Online is quick and easy.

- This article is for business owners who want to enter their credit bill of fare transactions manually in QuickBooks Online.

Manually entering credit card transactions provides you with the most accurate and up-to-engagement financials in QuickBooks Online or QuickBooks Pro. While depository financial institution feeds allow your credit cards to sync to QuickBooks Online, making transactions instantly viewable in the register, there'due south a fourth dimension lag between the actual credit card transaction and when the transaction shows equally pending earlier it posts to your credit card statement.

Pending payments will non transfer via bank feed. Merely an actual payment that has been candy via your credit card and appears on your argument will transfer to your bank feeds.

Given the fourth dimension lag while a transaction moves from pending to complete, consider manually inbound your credit carte du jour expenses, especially at the end of your accounting catamenia if you are using the accrual method of accounting.

Business concern owners and accountants may desire to manually enter credit card transactions into QuickBooks Online if the following is true:

- Your business has a depression number of credit card expenses.

- You are not able to import charges via QuickBooks Online depository financial institution feeds.

- You want the most up-to-date and accurate financials daily and monitor your budgets closely.

- You need up-to-date financials due to stop-of-accounting-flow reporting, and pending charges cannot be imported via QuickBooks Online bank feeds.

Did you know? Credit menu charges can show every bit awaiting for upwardly to five days.

Did you know? Credit menu charges can show every bit awaiting for upwardly to five days.

How to enter credit card charges into QuickBooks Online

The quickest fashion to enter credit card charges into QuickBooks Online is to manually key in the transaction and match those transactions to your bank feed once the bank feed transactions appear on your annals.

Some accountants and bookkeepers are used to manually inbound transactions from receipts, then reconciling the receipts to the credit carte du jour argument. Depository financial institution feeds speed up the reconciliation process and brand it more efficient.

Entering credit carte du jour charges into QuickBooks Online is a quick and easy process. Here is a step-by-step guide on how to manually enter credit bill of fare charges in QuickBooks Online.

Selection i: Enter transactions and match them to the banking company feed.

This method is used about oft, due to the simplicity and efficiency of matching and reconciling.

Consummate the following process:

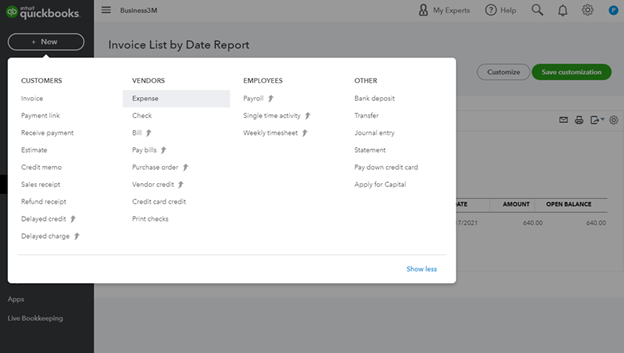

- At the height right of your screen, click "+New."

- Under the Vendors subcategory, click on "Expense."

- On the Expense page, fill up in the payee. If the payee information is already in your QuickBooks Online organization, the dropdown under Payee volition let y'all to select their name. If the payee is not currently in your QuickBooks Online system, click "Add together" to include their name on the dropdown list. Then enter the following information:

- Name

- Type: Options include Vendor, Client and Employee. Later selecting the type, yous can as well update with specifics near the payee, such as their address, telephone number, concern ID and Social Security number.

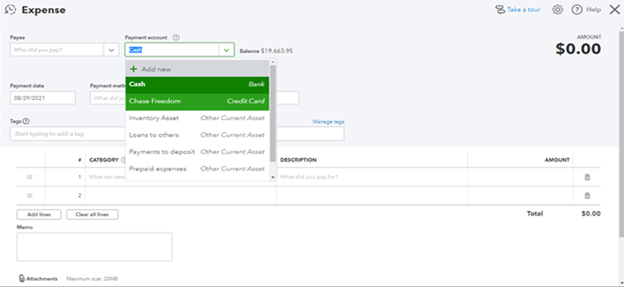

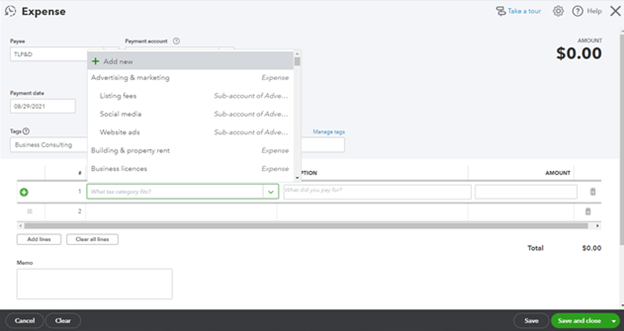

- In the Payment Account field, select the appropriate account. You'll run across a populated list, as shown beneath. If the account is not in the present list, select "+Add together new" and add the account information:

- Account type: Select "Credit Card," "Bank" or "Other Current Avails."

- Detail type: Fill out the correct options based on what you lot selected in a higher place.

- Name: Give the account a proper name.

- Clarification: Optionally, fill up out any additional information.

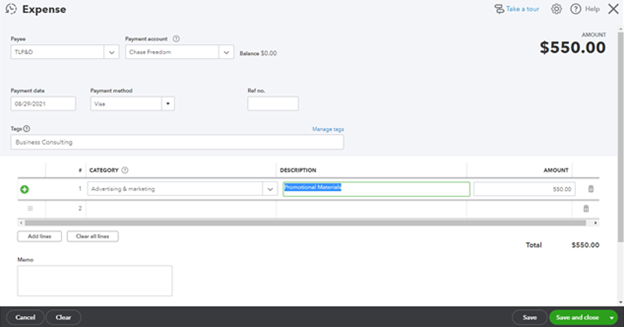

- Payment date: Enter the date of payment.

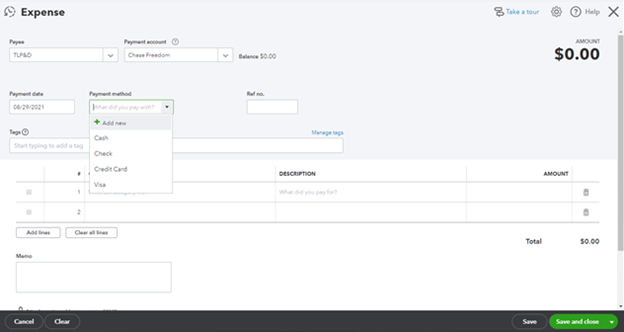

- Payment method: From the dropdown menu, select "Cash," "Check," "Credit Menu" or a previously added payment method from the programmed listing. If this menu does not recognize your method of payment, select "+Add together new" and key in your information.

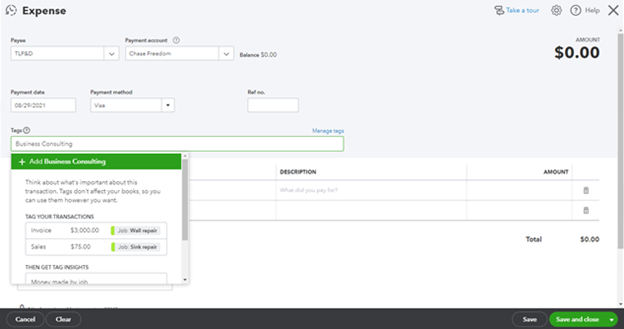

- Tags: Think of tags as custom labels that permit yous to runway, access and call back transactions. In the example below, a Business Consulting tag has been added to assist the user allocate this expense.

eight. What tax category fits? QuickBooks Online provides a dropdown of suggested categories. If none of the revenue enhancement categories draw your transaction, select "+Add together new."

- Description: Enter a clarification of the transaction and hit "Salve."

- Amount: Enter this number and hitting "Save."

FYI: If you reconcile with bank feeds, the date of the transaction may lag a solar day or ii from your manual entry. It can take one to five days for your credit carte to fully process a transaction.

FYI: If you reconcile with bank feeds, the date of the transaction may lag a solar day or ii from your manual entry. It can take one to five days for your credit carte to fully process a transaction.

Choice 1 alternative: Upload receipts.

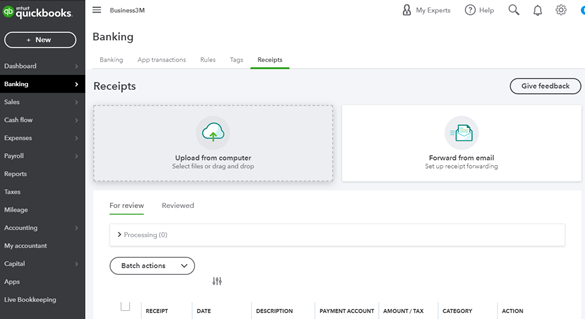

If you are used to uploading receipts to your figurer (or phone) and want to post and match them that way, there is an alternative to Option 1. Complete the post-obit steps:

- On the landing folio, click on "Banking" and so "Receipts."

- On the Receipts page, select "Upload from computer." If you're on your phone, the app allows you lot to add photos of receipts and upload them from there equally well.

- QuickBooks Online volition prompt you to match the transaction from the Banking command.

Option 2: Apply your bank feed to enter transactions.

Once you lot notice bank feeds, reconciling becomes about seamless, and you'll spend much less fourth dimension manually entering transactions.

Make certain your credit bill of fare is synced with QuickBooks Online and so y'all tin can easily import transactions to your register.

Once your bank feeds are updated and you have entered transactions from Option ane, match your banking company feeds with your entered transactions. Brand certain y'all don't add whatever transactions that accept already been manually entered into the system.

Pick iii: Enter transactions into the credit card annals.

Straight entering credit card charges into your register is the third selection. Choose this choice if you practise not use depository financial institution feeds or upload receipts from your calculator or phone.

If you have a very small number of credit card transactions, this may exist the best method for you lot. Or if you take a credit card that you no longer use that is no longer synced to your banking company feeds, but yous even so demand a record of transactions, this is a skilful method.

The following steps outline how to enter your transactions into the credit card register.

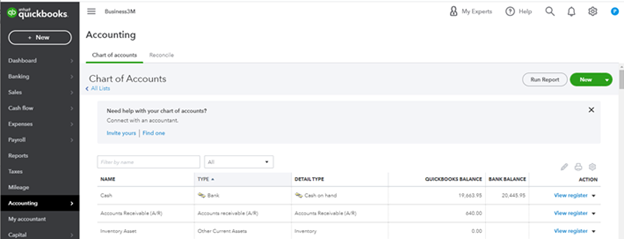

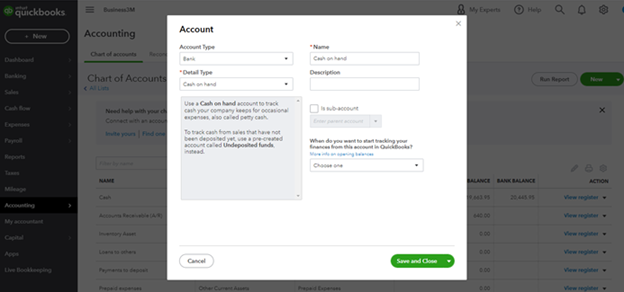

- On the landing folio, select "Accounting" and "Chart of accounts."

- Select "New."

- In this pop-upwardly window, consummate the following.

- Business relationship type: Select "Credit Carte" in this dropdown.

- Detail type: This volition update automatically, once you have completed the above.

- Proper name: This will too update automatically.

- Description: This step is optional.

- When do y'all want to start tracking your finances from this account in QuickBooks? Options in the dropdown include "Beginning of this twelvemonth," "Beginning of this month," "Today" and "Other."

- What was your account's residual on [date]? Enter your balance from that specific engagement.

Later yous have completed the pop-upward window, QuickBooks takes you to the Chart of Accounts.

- Find the account y'all just created and select "View Register."

- Click "Add CC expense" and complete the following items.

- Date

- Payee

- Accuse: Enter a dollar corporeality.

- Ref no. (reference number): This is optional.

- Memo: This is also optional.

- Hit "Save."

One time you have entered in one or all of your credit card transactions, you'll see a Reconcile pick on the top right of the page. Performing a reconciliation ensures your entries friction match.

How to enter credit card charges into QuickBooks Pro

If you accept the desktop version of QuickBooks Pro, yous will manually enter credit card transactions differently. QuickBooks Pro looks different from QuickBooks Online, but the process is somewhat similar. Before manually inbound your credit carte charges, ensure you have your credit card included within your nautical chart of accounts.

Tip: Interested in an alternative to QuickBooks Pro? Consider our review of Clover, our Merchant I review, or our review of ProMerchant instead.

Tip: Interested in an alternative to QuickBooks Pro? Consider our review of Clover, our Merchant I review, or our review of ProMerchant instead.

To enter your credit card transactions into QuickBooks Pro, click on "Cyberbanking," then "Credit Bill of fare Charges." Before Step ii, ensure "Purchase/Accuse" has been selected (QuickBooks Pro should populate this for y'all). So, fill up out the following:

- Purchased from: Select the vendor from the dropdown card.

- Date: Use the calendar to select.

- Ref no.: Optionally, fill up in a reference number to help code your transaction, making information technology piece of cake to organize and recall.

- Amount: Cardinal in the amount of the transaction.

- Memo: Describe the purchase via this text box.

- Additional information: While QuickBooks Pro volition automatically record the expense business relationship and transaction amount for you lot, here, you can add more data about the transaction. If you had one full transaction, merely the transaction included more one category of items, additional information is necessary. For instance, if forty% of your purchase was for estimator products (or function supplies) and threescore% of your purchase was for advertising materials, this is where you can separate and fully draw the transaction.

- Account: Select from the dropdown role to help code your expense, and hit "Save."

Whether you're a QuickBooks Online or QuickBooks Pro user, entering credit card charges on time and ensuring transactions are authentic, up to date, and available for accounting purposes is crucial to your business's recordkeeping. If QuickBooks isn't for you, read all our reviews of the best accounting software.

How Do I Register Credit Card Payments In The Qb Register,

Source: https://www.businessnewsdaily.com/16466-quickbooks-online-credit-card-charges.html

Posted by: millerthspolies.blogspot.com

0 Response to "How Do I Register Credit Card Payments In The Qb Register"

Post a Comment